In the previous part of this series of articles, we wrote up a list of companies that had gone burst or showed signs of financial strain. In the part four of this series, we have gathered a list of 10 more companies which have come crashing down from grace.

Read on to find out the timeline of each company’s demise!

10. Compaq

Founded by three senior executives Rod Canion, Jim Harris and Bill Murto in February 1992, Compaq was created when the trio got disillusioned with their jobs at Texas Instruments. The selling point of their PC line was that they based their designs on new features such as mobility, better specifications and graphics. Compaq also recruited engineers with decades of experience in the industry, making their products more trustworthy in the eyes of their customers.

Partnering up with Intel, Compaq managed to get a deal that allowed them to get the latest Intel processors for their PCs before those processors were sold to other manufacturers. This allowed their PC to be of the most advanced and highest specifications in the market. The computer manufacturer also sold their inventory exclusively to resellers, a strategy that allowed them to avoid competing directly with their resellers for sales at the consumer level.

With these strategies in place, Compaq reached a billion dollars in revenue in just five years. They also attained the status of being the fifth most popular PC brand in 1991, selling three billion dollars’ worth of equipment in that same year.

Unfortunately, Compaq’s early advantage also proved to be their undoing. To produce high end machines, the company had to continuously incur a high R&D cost. In the 1990s, computer jardware had advanced sufficiently such that competitors could upgrade their offerings with cheap off-the-shelves parts, causing Compaq to suffer a loss for the first time. The mind behind the business, Canion, was also kicked out of his own company and forced into early retirement by the senior management in the company.

Attempting to move in a new direction, Compaq started acquiring other companies, such as Digital Equipment Corporation (DEC) for a record high of nine billion. Compaq wanted to imitate IBM and Microsoft, which had success in the corporate side of the computer manufacturing market, but did not find much success in that area. Compaq also continued to suffer losses from overestimating demand for its computers.

The company also suffered from internal turmoil as multiple CEOs were hired and fired repeatedly over several years as Compaq’s profit declined. After the dot com bubble burst in early 2000s, Compaq’s share prices halved, and the firm amassed 1.7 billion in debt.

Compaq eventually merged with HP in 2002, but unfortunately, sales did not really pick up. HP discontinued the Compaq line of computers in 2013, ending the brand permanently.

9. Polaroid

Polaroid was founded in 1937 by two Americans, Edwin Land and George Wheelwright in Cambridge, Massachusetts. The company started out selling sunglasses that block specific light wavelengths, known as polarized sunglasses. The company’s CEO Land had numerous patents for polarize technology, and he used it to the company’s advantage to create products that other companies could not copy.

After a trip with his family that left his daughter asking why the picture taken from a camera was not instantly generated, Land created the first instant camera in 1948. It was commercially known as Polaroid Land Camera. Due to his patents, Land generated profits from his invention, and had a business model similar to the printer and ink industry, where the camera was sold at a low price but films required for the camera were sold at a premium.

Land continued to head the company for the next 43 years. In the late 1970s, as the trend of photography shifted from instant cameras to videotape, Polaroid unveiled the Polavision, an instant color home movie system. Unfortunately, the Polavision failed to do well in the market, and Land was forced to step down.

For the next two decades, the company tried to reinvent itself and attempted to cut cost by retrenching thousands of its employees. As they were late in entering the digital camera market, Polaroid failed to get a foothold in the market. Without good leadership, the senior executives in the company tried everything from digital cameras to scanners, but none were successful. Their failure in the beginning to shift to digital cameras in the beginning caused the dominoes to fall.

In 11 October 2001, Polaroid filed for bankruptcy. Many of its patents and assets were sold off, including the Polaroid brand name.

8. Pebble

Pebble was a startup by Eric Migicovsky with an idea for a smartwatch that could display messages on both iOS and Android smartphones. Migicovsky got into Y Combinator in 2001 with his startup, but did not raise much venture funds.

To realize his vision of the company, Migicovsky ran a crowdfunding campaign on 11 April 2012 on Kickstarter. This project reached its 100 thousand dollars goal in just two hours after launch, and received a total of 10.3 million in funding when the campaign ended in 18 May 2012.

The watch prototype faced numerous obstacles during the manufacture phrase, but the startup was able to start shipping the smartwatches in January of 2013. In just over a year, the popular smartwatch had over a thousand apps from independent developers in its online app store.

Pebble created two more products, Pebble Time and Pebble 2 in its product line. However, like the first Pebble, production was delayed for crowdfund campaign backers due to overwhelming demands, leading to complains from unhappy customers. Unfortunately, Pebble could not match the iWatch when it was released.

Unfortunately, its sales in 2015 and 2016 did not do as well as Pebble expected. The company had huge debts from its suppliers and was struggling to try and stay afloat. Migicovsky tried measures that included retrenching employees and moving its headquarters to a cheaper and smaller location, but despite his efforts, Pebble was unable to survive.

Pebble was sold to Fitbit in 2017 for 40 million, a huge loss for its investors.

7. StumbleUpon

StumbleUpon was a Canadian website company founded by Garrett Camp, Geoff Smith, Justin LaFrance and Eric Boyd in November 2001 when they were undergrads. Their website was a search engine that pushed recommended and popular content to its users, and allowed users to rate websites, pictures and videos uploaded by other users.

When the website took off with its user base, Silicon Valley investor Brad O’Neill helped the founders move to San Francisco Bay Area, and brought in several famed investors for the startup, including Tim Ferriss, Mitch Kapor and Ram Shriram.

In 2007, StumbleUpon was acquired by eBay for 75 million. However, Camp and his co-founders later bought it back from eBay in April 2009 due to problems with the new parent company, and managed to raise a Series B of 11 million in 2011.

However, due to failing to keep up with new discovery site rivals like Pinterest, traffic for StumbleUpon began to drop. Camp resigned as CEO in 2012. In the following year, the website startup retrenched 30 percent of its staff, and was acquired by 5by nine months later. 5by attempted to raise funds for the website in 2015, but failed and StumbleUpon went into the red. Camp then bought out all other investors, regaining his control over his company.

On the last day of June in 2018, StumbleUpon officially shuttered and Camp merged the old website into his new startup, Mix.

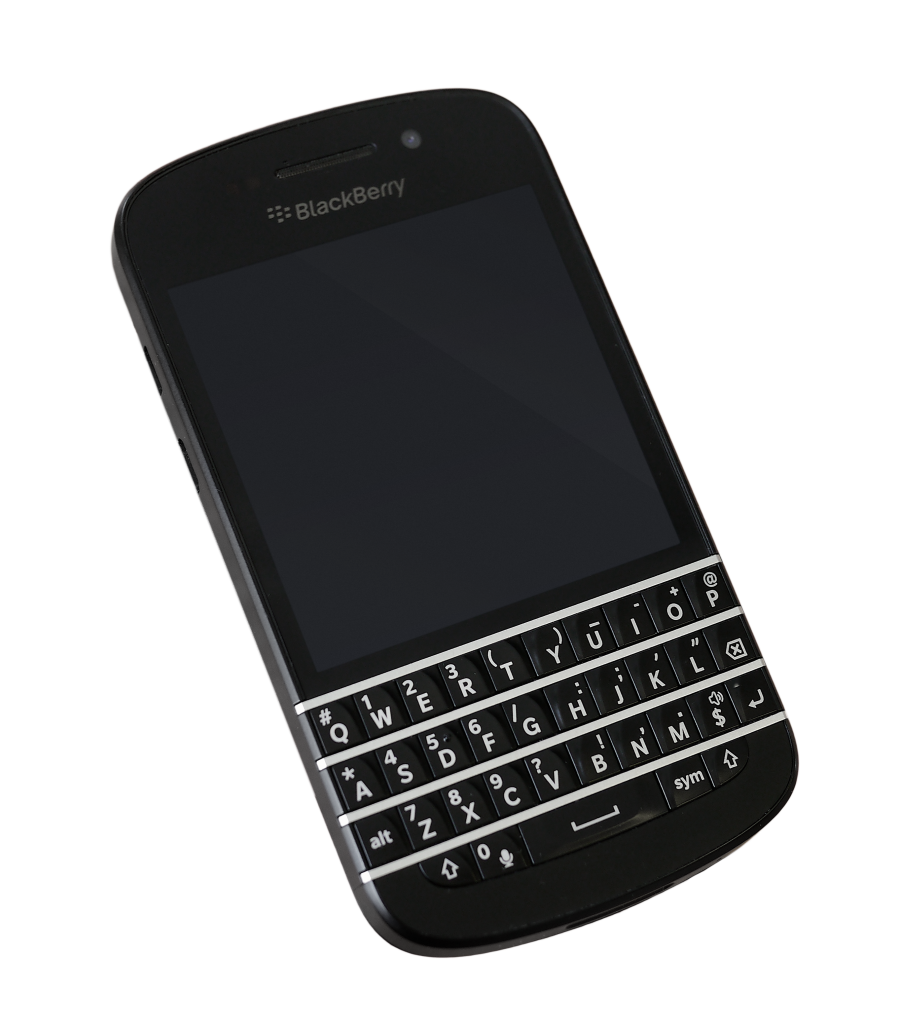

6. Blackberry

Blackberry Limited was originally known as Research In Motion (RIM). This Canadian company was founded by Mike Lazaridis and Douglas Fregin in 1984 when they were students. The company developed solutions that allowed devices to communicate wirelessly, and created the first two-way pager that could send messages in 1996, known as the Inter@ctive Pager.

Three years later in 1999, the first Blackberry 850 pager was born. The pager was able to receive push emails from a Microsoft email server, and set the path for a new line of smartphones, the Blackberry. The first Blackberry smartphone was released in 2002, with functionalities such as pushing emails, calling, text messaging known as BBM and web browsing. By concentrating on email functions exclusively, Blackberry managed to dominate the smartphone market. Businessmen loved the Blackberry for its convenience.

However, being unable to catch up with new market trends caused Blackberry’s downfall. The company refused to build fully touchscreen phones when Apple and Google entered the smartphone market in 2007, believing that their product was superior and consumers wanted a keyboard based smartphone. Consumers, however, loved the fully touchscreen phone, and voted with their wallets by ditching the Blackberry for them.

The phone manufacturer also made the mistake of making their popular text messaging exclusive to their devices, hoping it would save their business. Unfortunately, with the arrival of messaging apps such as Whatsapp and iMessage, BBM lost ground and eventually faded away when consumers jumped to the new popular apps.

Blackberry was almost sold for 4.7 billion to Fairfax Finance in August 2013, but the company’s executives decided against it at the last moment. They wanted to rebuild the brand and re-enter the smartphone market, believing that they would reclaim their crown as the king of smartphones. The company launched several handsets, but none were very successful against the new kings.

Blackberry later switched to using Android OS, but by then it was too late. The ship had sailed and Blackberry was dwarfed by the new smartphone giants, Apple and Google, ending with about 0.3 percent total market share in 2017.

In September 2018, Blackberry announced that they would stop making smartphones, and instead shift to focus on enterprise software instead.

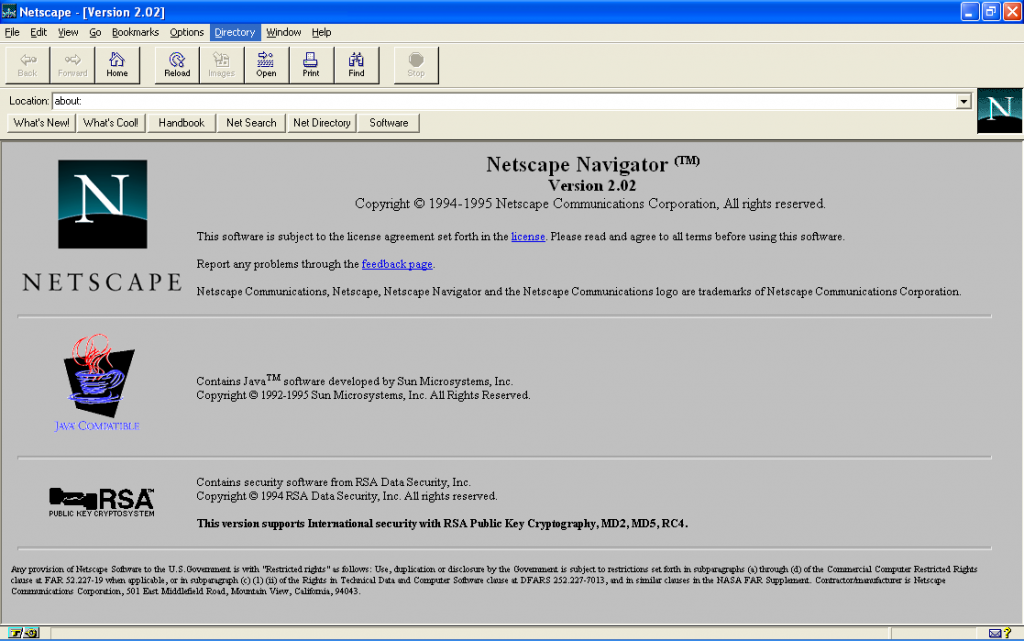

5. Netscape

Netscape was founded by Jim Clark and Marc Andreessen, under the company name Mosaic Communications Corporation in April 1994. The company released its first product, the Mosaic Netscape 0.9 in October 1994, which quickly took over the browser market at that time. The company was later renamed Netscape, and the browser’s name was also changed to Netscape Navigator.

Netscape went public just over a year later, on August 9 1995. The company’s stock launched at $28 per share, and rocketed to $75 on the very first day of trading, and closing at more than double the amount of $58.

The success of Netscape would later lead to the rise of internet companies that would later create the dotcom bubble. Netscape focused on publicity, and created a browser that runs the same no matter which platform it was on. There was a rumor that Microsoft viewed Netscape browsers as a threat, so they proposed a secret plan to Netscape to not build browsers for Windows, but this was never verified.

When Microsoft released the Windows Explorer browser as a free product in a Windows 95 update, it created a head on browser war with Netscape. This war lasted for several years, with both companies vying constantly, trying to out-create each other in functionalities. Microsoft would eventually win the first browser war, as Netscape did not have the amount of resources Microsoft had.

Netscape was a product which users had to pay for, and was unable to compete with ‘free’. The company did not make its browser free until January 1998. Critics also complained that Netscape’s new functionalities were not tested properly before release, resulting in numerous bugs. By then, the company was suffering financial trouble and had a retrench a large number of employees.

On November 24 1998, AOL acquired Netscape for 10 billion. However, when Time Warner bought AOL in 2003, Netscape was permanently scrapped, and most people working under the Netscape brand were fired.

4. Motorola

Motorola was a telecommunication company founded by Paul and Joseph Galvin in 1928, who were brothers. The company was originally named Galvin Manufacturing Corporation when the pair purchased a bankrupt company Stewart Battery Company’s blueprint and equipment at a bargain price of $750 (about eleven thousand in today’s value).

The company started out by selling battery eliminators, which were used to allow battery powered radios to run using electricity. However, when this technology quickly became obsolete, and the company managed to keep itself afloat when it was successful in creating a cheap car radio that could be installed in vehicles. This radio was named Motorola, and when the product proved to be successful, Galvin Manufacturing Corporation changed its name to Motorola.

Motorola sold these car radios to various US states police department in November 1930, and business took off from there. Motorola later went on to product the AM SCR-536 radio, an important communication device for Allied troops in World War Two. The company later became public in 1939, selling television and radio sets.

After World War Two, Motorola continued to lead in innovation and product creation, including communication devices for NASA astronauts in space, color television and cellphones. Motorola also invented the Six Sigma process, a standard for improving quality of product used even to this day.

However, despite Motorola’s brilliant inventions, it lost the cellphone competition to Nokia in 1998. Although they made a comeback by selling their latest cellphone offering in 2000 with Motorola Razr, they had stopped innovating and began to lose out big time. The company was also late to the 3G party, and by the time they caught up, emerging brands such as Apple and Samsung had already left them in the dust.

In 2009, having lost 4.3 billion from the previous years, the Motorola Company had to be cut up and sold off. The company auctioned off its cellular infrastructure to Nokia in 2010, and Motorola Mobility department to Google and Lenovo in 2014.

3. Myspace

Myspace was a social media website founded by Brad Greenspan, Chris DeWolfe, Tom Anderson, and a small group of programmers in August 2003. These people were originally employees of eUniverse, a digital marketing company. The company brought a few more people during the development phrase of the website, including technical expert Toan Nguyen and CTO Aber Whitcomb.

In 2003, the dominant social media website was Friendster. When Myspace was launched, the website’s superior architecture allowed it to run many times faster than Friendster. Myspace also allowed more customization of posts, background and profile pages. This customization features made Myspace very popular, and they dominated as the new and most popular social media.

By 2004, Myspace had over a million users, and in a year’s time, they had amassed 20 times of that. Myspace was given an offer to acquire Facebook in February 2005. However, Zuckerberg’s buyout offer of 75 million was rejected.

In July 2005, News Corporation bought Myspace for 580 million. The site’s users were still growing at an incredible rate. In 2006, 200 thousand new users were signing up every day. Myspace launched localized versions of the website for eleven regions in the same year. In August 2006, Myspace signed up its 100 millionth user, and signed a major deal with Google, providing it with 15 million dollars of ad revenue every month.

However, barely two years later in 2008, Facebook gained on Myspace with users, and number of active Myspace users continued to drop. That was due to Myspace’s badly optimized and ugly webpages due to advertising. In comparison, Facebook looked sleek with a clean interface, unburdened by massive amount of ads. As users continued to decrease, Myspace attempted to win them back by doing a design overhaul, which unfortunately irked the remaining user base who hated change, and most jumped ship to Facebook.

Myspace attempted to save the company by firing almost half of its workforce, but it was futile. By 2011, Myspace had lost over 150 million in revenue, and was put up for a fire sale of 35 million, a far cry from its hayday of being valued at 12 billion in 2007.

2. WeWork

WeWork was a US real estate company specializing in coworking space. Founded in 2010 by Adam Neumann and Miguel McKelvey, the pair launched the startup in New York. To get started, the pair sold a third of the fletching company for 15 million.

Wework grew rapidly by gobbling up commercial real estates space. By 2014, the company had become the quickest expanding leaser of office space. Huge number of well-known investment banks and venture capitalist financed the company, include JP Morgan, Harvard Corporation and Goldman Sachs.

In January 2016, Wework was classified as a unicorn, which is a startup valued at over a billion dollars. It was featured on the cover of Fortune magazine, and held another round of financing in the same year. By then, Wework was valued at 16 billion.

In 2018, the startup was experimenting with expanding to universities, and opened its first office space in University of Maryland. Wework also raised 5 billion total funding from Softbank, one of the biggest venture capitalist from Japan. The company continued expanding its office space for the next year, and changed its parent company name to We Company.

In 2019, Wework filed for an IPO to go public. However, heavy losses from the company made investors wary, who did not see Wework becoming profitable in the long run. Neumann was heavily scrutinized, and blamed for the company’s losses. After revision, Wework was re-evaluated to be worth 8 billion instead of the originally proposed 20 billion.

Neumann was later outed by the board of directors, and the company also retrenched 20 percent of its workers in September of 2019. By the same month of the next year, Wework had lost almost 90 percent of its initial valuation.

1. Theranos

Theranos was the brainchild of Elizabeth Holmes, who originally wanted to make a medical patch that could monitor a patient’s blood and automatically inject drugs into the patient’s system. In 2003, Elizabeth Holmes became a Stanford dropout at the age of nineteen, and started the biotech company ‘Real-Time Cures’ with her college fund.

Armed with a vision to make blood testing cheaper and more accessible for people, Holmes proposed a solution where diseases could be detected from a person with just a few drops of blood from the person’s fingers. Unfortunately, payroll services often got her company’s name wrong, hilariously calling it ‘Real-Time Curses’ instead, so the startup’s name was later changed to Theranos.

After pitching the idea to a few high-profile investors, Theranos was able to secure 6.9 million in funding, with a 30 million valuation in December 2004, merely a year after the company was started. Due to high profile investors getting interested in this company, it attracted many other wealthy and well-connected individuals to give funding to Theranos.

In the year 2010, Theranos managed to raise almost a hundred million in capital, against the valuation of a billion dollars, making it one of the most secretive unicorns of Silicon Valley. The startup remained in stealth mode to develop its revolutionary technology, and Elizabeth Holmes’ attractive sales pitch kept investor money pouring in.

In 2013, Theranos officially unveiled its website, the mini container ‘nanotainer’ to store blood samples, and the Edison, the blood testing machine. Holmes claimed that with just a few drops of blood from a finger, multiple tests can be run on the tiny sample with the Edison. However, the company did not publish any data to verify its claims, and many skeptical medically-trained professionals did not believe that Theranos had managed to invent such a device.

Despite all the suspicions, Theranos signed an agreement with Walgreens to let people take blood tests at Walgreen stores. The startup even lobbied successfully to add a new law in Arizona that allows people to get blood tests done without a doctor’s letter. By 2014, Theranos’ valuation had surged to nine billion.

However, barely a year later, the house of cards came crumbling down. Readings off the Edison and other devices invented by the company were shown to be inaccurate and false, which could lead to wrong diagnosis and severe consequences for patients. While the company knew about these discrepancies in the results, the devices continue to be used, without regard for the wellbeing of the patients. Lawsuits from numerous patients and Walgreens were filed. Both Holmes and her co-founder Balwani were also put on trial for wire fraud and conspiring to commit fraud.

On September 14 of 2018, Theranos was officially shuttered, and investors lost hundreds of millions of dollars.

Bonus. Groupon

Groupon was an American company founded by Andrew Mason, who got the idea after having trouble cancelling a mobile phone contract. He first launched a website in 2007, with the idea that people would use social media to get together and achieve something together. However, the website did not do as well as he expected, but his co-founder Lefkofsky found a group of people who wanted to save money by mass buying things together. From there, the idea for Groupon was born.

This new startup officially launched on November 2008, and started off offering deals like one-for-one for restaurant chains around the startup’s office building. These deals proved to be very popular, and in just over a year, the company had grew from just a few people to over 300 staff.

Both Yahoo and Google tried to acquire Groupon, but their offers of 3 billion and 6 billion respectively were rejected. With no other alternative, Groupon decided to launch their own IPO and enter the stock markets.

In 2011, Groupon went public. However, controversy arose when Groupon founders used most of the venture capital it raise to pay themselves and their early investors instead of reinvesting the money back into the company. The metric used to track Groupon’s profitability also came into question, as it was a non-standard metric not used by other public companies. Skeptics accused Groupon of trying to hide its unprofitability. An investigation endured, and it was found that Groupon had lost over 400 million in the year 2010 alone.

One year after going public, Groupon’s stock had lost over eighty percent in value. This was partly due to Groupon not being profitable, as well as numerous merchant problems. Many merchants had problems trying to keep up with demands while their deal was running. Other merchant problems included having problems trying to get a certain type of deal onto Groupon, or due to losing money in deals in return for little to no customer loyalty.

Mason was fired from his own company, and while the company is still around, its revenue had been going down, and its glorious rebound nowhere in sight.

Which of the above companies failed the hardest? Leave your comments below!