In the previous article, we listed 10 big companies (+ 1 bonus!) that failed. Now we present part two of the series about companies that failed and went bust. In this list, we look at big companies, specifically those that have long histories but met with catastrophic failures within a relatively short time due to inability to adapt to changing markets. Read on to find out the top ten companies that failed spectacularly!

10. Eastern Air Lines

Eastern Air Lines, A.K.A Eastern, was a US-based airplane company. One of the biggest four domestic carriers in its heyday, Eastern was founded in 1926 with the name Pitcairn Aviation in Miami, Florida. The airline started by making connecting flights between Florida and New York, and this route became one of its most profitable routes.

Between 1938 and mid-1950s, with fifteen daily flights, Eastern Air Lines rose to become one of the most wealthy air carriers. The airline acquired Colonial Airlines in 1956, bringing flights into Canada. Eastern went on to become Disney’s official airline in 1971, bringing them recognition throughout the States.

However, signs of trouble was brewing. Besides having to compete with its main rival Delta Air Lines, Eastern had to fight with other smaller and cheaper airlines for passengers. Unable to handle the competition, Eastern began to bleed money.

In 1980s, things were getting worse for the carrier. After being slapped with a fine of 9.5 million for safety violations, the carrier faced labor strikes, causing it to lose millions more in ticket sales and cancelled flights. Unable to take the losses or continue competing with other airlines, Eastern filed for bankruptcy in 1989.

Eastern Air Lines officially shut down on January 19th in 1991.

9. RadioShack

Radioshack was started by two brothers Theodore and Milton Deutschmann in a small retail store in 1921. As a shoestring operation in downtown Boston, the brother acquired cheap and low quality parts from Japan, when Japan was known for sub-standard manufactured goods at that time. They subsequently acquired the nickname ‘Nagasaki Hardware’. Attempting to expand their business, the brothers launched a mail order catalog in 1939.

By 1960, however, the business had more or less went broke as the founding brothers did not have funds to cope with store expansion and their extensive catalog. They were brought out with 300 thousand dollars by Tandy Corporation.

The acquisition brought RadioShack back to life, and there was a period of hikes in profit. For the next three decades, RadioShack pivoted into areas like computers and television repair, which proved to be immensely popular with customers.

In the 1990s, hoping to revamp its business and ramp up profit, RadioShack tried to go in the direction of competing with bigger brands like BestBuy and Walmart for market share in consumer electronic products.

Multiple failures, including a 35 million dollar loss for an unsuccessful barcode reader, caused the start of financial trouble for the company. For the next two decades, multiple bad bets and decreasing profits caused the company’s stock prices to tumble rapidly. Multiple rounds of retrenchment were held to try to keep the company afloat.

Despite these measures, RadioShack saw its stocks drop from $24 to $2 from 2009 to 2011. By late 2014, it was estimated that the company was bleeding a million dollars for each day in operation. On February 5 of 2015, RadioShack declared bankruptcy.

8. Circuit City

Circuit City was an American electronics retail store founded by Samuel Wurtzel in 1949 when television was becoming popular. He named his new company Wards. In just a decade, Wards had expanded to four stores in Virginia, and was moving on to other states such as New York, Alabama and California.

After going public and listing its stocks in the New York stock exchange in 1984, Wards officially changed its name to Circuit City. With a focus on customer service, the retail giant became known for its exceptional service. Growing rapidly during the 1990s, Circuit City quickly became the second largest electronic retail store.

However, in the new millennium, as the numbers of their stores grew, their service staff became less warm towards customers. Locations of their mega stores were also built far out in obscure places, making it hard for customers to reach them. To add on to their problems, failing to acquire new inventory like Apple and gaming products which consumers sought after caused Circuit City to fall behind in market share.

In an attempt to keep investors happy, Circuit City decided to increase the number of its stores. The company also attempted to cut costs by firing off over 3000 of its veteran salesforce. However, as e-commerce grew, companies such as Amazon took over the online space, leaving Circuit City to lose the retail war on both physical and cyber space.

To add injury to insult towards its staff, Circuit City removed commissions for all sales and cut wages for new employees. Unable to sustain operation costs, a trend of firing employee also started in 2008, when the retail giant retrenched over 20 percent of its workforce. In November 2008, Circuit City declared bankruptcy, and had its stocks removed from the stock exchange.

The former retail giant announced closure on 16 January of 2009, and all its stores were permanently closed on 8 March of the same year.

7. AIG

American Insurance Group, or better known as AIG, is a US insurance giant with presence in over 80 countries around the globe. It was established on December 19 of 1919 in Shanghai China by American Cornelius Vander Starr, and quickly gained a foothold in Asia selling general policies.

Seven years later, the firm had opened its American branch. By 1930, the insurance firm managed to enter Latin American countries and started branching out from there. Headquarter of the company was shifted from Shanghai to New York in 1939.

Although affected by World War Two, AIG recovered and expanded into European countries in the 1950s. New products such as accident policies were innovated by the company, and the insurance giant switched to using independent non-contract workers to save costs. In 1969, AIG went public.

In early 2000s, although the company continued to expand into territories like Russia, its accounting scandals and regulatory issues forced AIG to pay a fine of over a hundred million dollars to the US SEC. During the financial meltdown of 2008, when AIG faced severe financial difficulties, the US government used 180 million dollars to bail out the insurance giant. AIG’s collapse would have caused irreparable damage to the economy, with hundreds of thousands of people out of work. Without the backing of the US government, AIG would have gone down in history as one of the biggest global insurance firms that collapsed in the 2008 financial crisis.

6. AOL (America Online)

AOL, or American Online, is a US internet service provider with web portal. It began as Control Video Corporation (CVC) in 1983, an online server with modems products that track Atari games’ high score. The modems allowed players to download games to play locally. Unfortunately, the idea failed and within six months, the company was near bankruptcy.

In 1985, CVC was re-founded as Quantum Computer Services, and provided the earliest online gaming services. Quantum introduced some revolutionary online services at that time such as the first Massive Multiplayer Online Game (MMORPG) with pictures. Dial-up connection was also launched at around the same time. Distributing free trials aggressively, Quantum managed to overtake its rivals and become the dominant online service in the US market.

The 1990s decade was one of massive growth for AOL. They acquired other smaller companies at the time like MapQuest and Netscape. More than half of all US households with internet access used AOL. However, due to their continuously busy or bad signals from trying to accommodate too many users, many people cancelled their subscriptions due to frustration.

In January 2000, AOL merged with Time Warner to form AOL Time Warner. AOL continued to launch innovative services for email, and bundled software such as antivirus for its subscribers. However, the merger was considered a disaster as both companies’ culture did not fit. This caused a detrimental effect on the internal working of the company.

In 2006, America Online officially changed its name to AOL, and outsourced its customer support services from USA to India completely. Trying to save the company, AOL made its email services freely accessible to the general public to compete with products such as Microsoft Hotmail and Yahoo Mail. However, its revenue continued to drop. In 2007, the company had to retrench about 40 percent of its workers.

For the next ten years, AOL rapidly expanded its online inventory of products in an attempt to win back customers. It was a bad decade as more than 80 percent of the company’s paying customer base had switched to free plans. These products include AIM, AOL news and AOL Local. When the new products did not bring back customers as expected, AOL shed a large amount of their offerings. Turning towards a new business direction, the company began selling ads in partnership with Microsoft and Yahoo in an attempt to push back Google’s dominance in that area.

In May 2015, the dying AOL was acquired by Verizon at a deal price of $4.4 billion dollars.

5. HMV

HMV was an English retailer, specializing in music and movie products. Founded in the 1890s, the company with the iconic dog gramophone logo started out as a recording company. The company opened its first retail store in London in 1921 selling gramophones. By 1931, they had expanded to selling store branded television and radio sets.

The retail firm was successful selling these electronics for the next three decades, and started expanding throughout the UK in 1966. The next few decades were spent spreading across the globe aggressively. By the time its 75th anniversary rolled around in 1996, HMV had become the largest store specializing in music in the UK. To celebrate the occasion, the company opened the world’s largest music retail store in where it started: Oxford Street, London.

HVM went public in 2002, with a valuation of a billion pounds. However, despite their IPO, the company had failed to hop onto the online music buying and streaming trend, with its CEO dismissing the idea of going online as a fad.

The internet, however, turned out to be a major point in HMV’s downfall. HMV’s failure to develop an online presence caused it to lose a lot of sales to e-commerce businesses, and it entered restructuring in 2013. To save costs, at least 50 stores around the world closed down or were sold off, leaving a ton of employees jobless. With most of its debt bought out by Hilco group, and later Sunrise group, HMV’s failure to jump onto the online bandwagon led the company down a path of decline over the years.

HMV closed down its flagship store in Oxford Street in 14 January 2014.

4. WorldCom

WorldCom, later known as MCI WorldCom Inc, was an American telecommunications company. Founded in a café in 1983 by Bernard Ebbers and three others entrepreneurs, it was first launched as Long Distance Discount Services.

In a short span of six years, the company acquired over 60 telecommunications companies. After acquiring a public company Advanced Telecommunications Corporation, Long Distance Discount Services renamed itself to WorldCom and went public.

In November 1997, WorldCom and MCI Communications, another big communications company, merged to form MCI WorldCom, the biggest merger in all of US history in the 1990s. The firm later attempted to merge with Sprint in 1999, but was denied due to monopoly laws.

Unfortunately, trouble was brewing in the background for WorldCom. In June 2002, an internal audit uncovered a massive financial hole of 3.8 billion in fake transactions. This fraud was considered the largest fraud committed in the US until the Bernie Madoff’s Ponzi scheme.

Less than two months after the massive deceit, WorldCom filed for bankruptcy and held its proceedings alongside Enron. The founder Bernard Ebbers was sentenced to 25 years in prison for his part in the fraud.

3. Pets.com

Pets.com was a San Francisco based e-commerce company that was launched in November 1998 by Greg McLemore when the dot com bubble was in full swing. The ambitious website aimed to become the largest online supplier of pet products to consumers.

The company created an iconic dog sock puppet, and advertised aggressively across the States. After being interviewed by media such as Good Morning America and People magazine, the mascot of the company became ingrained as the go to for pet products. The iconic sock puppet also appeared in a 1.2 million Super Bowl commercial in January 2000.

Pets.com went public in February of 2000 with a valuation of 82.5 million dollars. One of the major investors of this company was Amazon, which had a 30 percent stake in the company. The company’s share debuted at 11 dollars, and peaked at 14 dollars.

However, numerous business problems plagued the company at its core. Pet food profit margin was razor thin, and shipping heavy items was expensive. As customers bought pet supplies in bulk, Pets.com needed to solve the core business problem of having to ship heavy cans and sacks of pet chow at a price which consumers can accept. The company failed to find a solution for this core problem.

There was another serious problem eating away at the company’s path to profitability. Despite spending lavishly on advertisements, Pets.com failed to differentiate its business with unique products or strategies, and many consumers were unable to see the difference between Pets.com and its competitors at that time.

To make matters worse, the online shop was losing money with every sale since it was giving away discounts on pet products. Pets.com made only six hundred thousand dollars after spending almost twelve million in nine months. To cut costs, the company moved its operations to Indiana in September 2000, but it did not do much to help the company stop bleeding money.

Pets.com officially shut down in November 2000, a mere 2 years from its launch. Its iconic mascot unfortunately became a symbol to mock startups headed for impending disaster.

2. Atari

Atari was founded in 1971 by two talented American engineers, Nolan Bushnell and Ted Dabney. The duo created the world’s first arcade video game Computer Space. Atari was formally incorporated in 1972 and released Pong in the same year.

The first Atari device that allowed players to play multiple games was the Atari 2600. With a price tag of $199 (approximately $900 in 2020), the company had trouble coming up with funds to mass produce these devices for sale. Bushnell and Dabney decided to sell off the company in 1976 to Warner Communications (now known as Time Warner), and Bushnell was fired from his position as CEO after a serious disagreement with Warner’s management.

The Atari 2600 was a huge success and millions of the devices were sold. However, the company’s good fortune declined in 1983 during the infamous video game crash, where they lost money to the tune of 500 million dollars. Trying to recoup losses, Warner Communications tried to sell troubled sections of the gaming company, but negotiations fell through.

Atari eventually was sold off to Namco and Mitsubishi, which continued to use the Atari brand name to release devices and games to this day.

1. Blockbuster

Blockbuster was originally set up by David Cook on October 19, 1985 in Dallas, Texas. His first retail store quickly became popular selling VHS tapes, and Cook saw an untapped potential for video rental when running the business. The man had prior experience running a software company, Cook Data Services, and was able to use his experience in software to ramp up his new venture rapidly.

After winning a lawsuit with Nintendo over video game rental in 1987, Blockbuster began to include video game titles in its inventory. In barely two years, the chain had expanded to 19 stores across the country. Two other experienced co-founders Wayne Huizenga and John Melk also came onboard, bringing their expertise from their businesses.

Throughout the 1990s, Blockbuster bought out many of its competitors, including big names at that time like Erol. By the end of 1990s, the company employed over 80 thousand people and was valued at three billion dollars. Blockbuster became a household name for rental services, including music, video and games.

Unfortunately, trouble was brewing on the horizon. On-demand video services and cable TV was beginning to go mainstream, and the three founders were worried about the future of the company. In 1994, Viacom acquired Blockbuster for 8.4 billion. When DVDs became the de facto format for movies in 1997, Warner Bros offered a deal with Blockbuster to rent out new movies before they went on sale to the public. However, Blockbuster refused the deal, triggering one of the events for its downfall.

The other major events that led to Blockbuster’s fall from the top included failing to successfully launch a video on-demand service despite partnering with Enron, and failing to buy out Netflix when it was still a small company renting out DVD by mail service. Refusing to adapt to new internet technologies and insisting on sticking to DVDs and later Blu-rays, Blockbuster’s stubborn ways was the catalyst for its collapse in 2010.

In July 2010, after its stocks dipped below a dollar, Blockbuster was removed from the New York Stock Exchange. By September of the same year, with over 900 million in debt, Blockbuster filed for its first bankruptcy. Blockbuster was later sold to SK Telecom for 320 million, and most of its stores were liquidated.

In 2019, only a single retail store of the once world famous rental chain remained in Oregon.

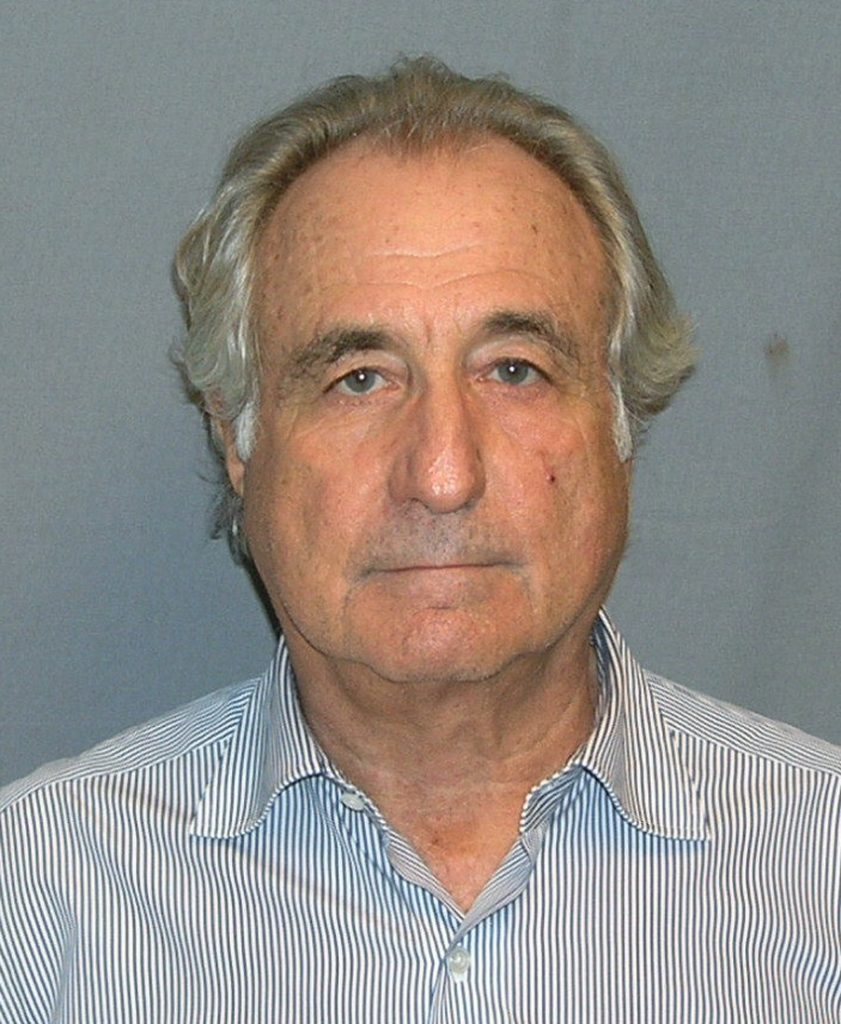

Bonus: Bernie Madoff Investment Securities LLC

Bernie Madoff Investment Securities LLC was founded by the man of the same name, Bernie Madoff, in 1960, as a penny stock trading company. To compete with its competitors at that time, Madoff developed a software program that broadcast stock quotes. This program became today’s NASDAQ, a core part of the stock market.

In the 1970s, Madoff Investments Securities started a hedge fund. To attract clients, the fund was marketed as an exclusive fund. Madoff claimed that he was earning money with a unique but legitimate trading method, and courted wealthy Jewish individuals. People who were invited to his fund were reluctant to leave as they believed that Madoff was a financial genius in the markets.

By 1992, Madoff’s trades were 9 percent of the daily amount in the New York Stock Exchange. However, for over 40 years, the firm was a sole propriety, and only became a limited liability company (LLC) in 2001. By then, the firm had about 300 million dollars in assets on paper.

To keep his scheme hidden, Bernie Madoff reported consistent growth of ten percent per year, unlike other Ponzi schemes with obvious red flags like over 20 percent every year. Several people suspected Madoff of front running, or doing insider trading, or running a Ponzi scheme due to his constant fund growth. Several individuals pointed out their suspicions, but the government did not go ahead with the investigation of these speculations.

Despite being investigated over eight times over the company’s lifetime of 16 years, the SEC and other financial regulators did not find any problem with Madoff’s fund or company audit when they did their regular checks. To avoid a throughout investigation, Madoff refused outside audits and circumvented assets checking by reportedly selling all assets it held at the end of every period.

In 2008 during the financial crisis, the Madoff Ponzi scheme came crashing down. With more money going out than new money coming in, the Ponzi scheme was collapsing. On 10 December 2008, Madoff confessed to his sons that he was running the giant con at that time. His sons reported him to the Feds and the SEC. Madoff was arrested the very next day.

Madoff’s firm was found to be running the largest Ponzi scheme in the world, with an estimated value of 65 billion dollars. He claimed that the scheme started in 1990s, when he failed to meet investors’ expectations for earnings, causing him to start cooking the books. However, there are speculations that the Madoff hedge fund had always meant to be a fraud right from the start.

As a warning to other would-be fraudsters, Madoff was sentenced to 150 in prison, and his company went down with his arrest.

Magnificent site. Lots of helpful information here.

I’m sending it to several pals ans also sharing in delicious.

And obviously, thanks in your sweat!

What’s up, always i used to check website posts here early

in the dawn, because i enjoy to learn more and more.

Great site you have here but I was curious if

you knew of any discussion boards that cover the same topics talked about in this article?

I’d really love to be a part of group where I can get opinions from other knowledgeable individuals that share the same

interest. If you have any recommendations, please let me know.

Thanks!

Thanks for the article post. Really thank you! Keep writing. Phyllys Tyson Puff

You could certainly see your enthusiasm in the work you write. Ginny Quentin Warms